In-Depth Analysis Of USD/JPY: Trading Strategies And Market Trends – August 2024

Introduction

The USD/JPY currency pair is one of the most actively traded pairs in the Forex market, known for its liquidity and volatility. As of August 2024, the pair has attracted significant attention due to several economic factors, including shifts in US monetary policy, geopolitical developments in Asia, and Japan’s economic data. This article delves into the key trading strategies, recent market trends, and future outlook for USD/JPY, providing traders with valuable insights to navigate the Forex market effectively.

Current Market Overview

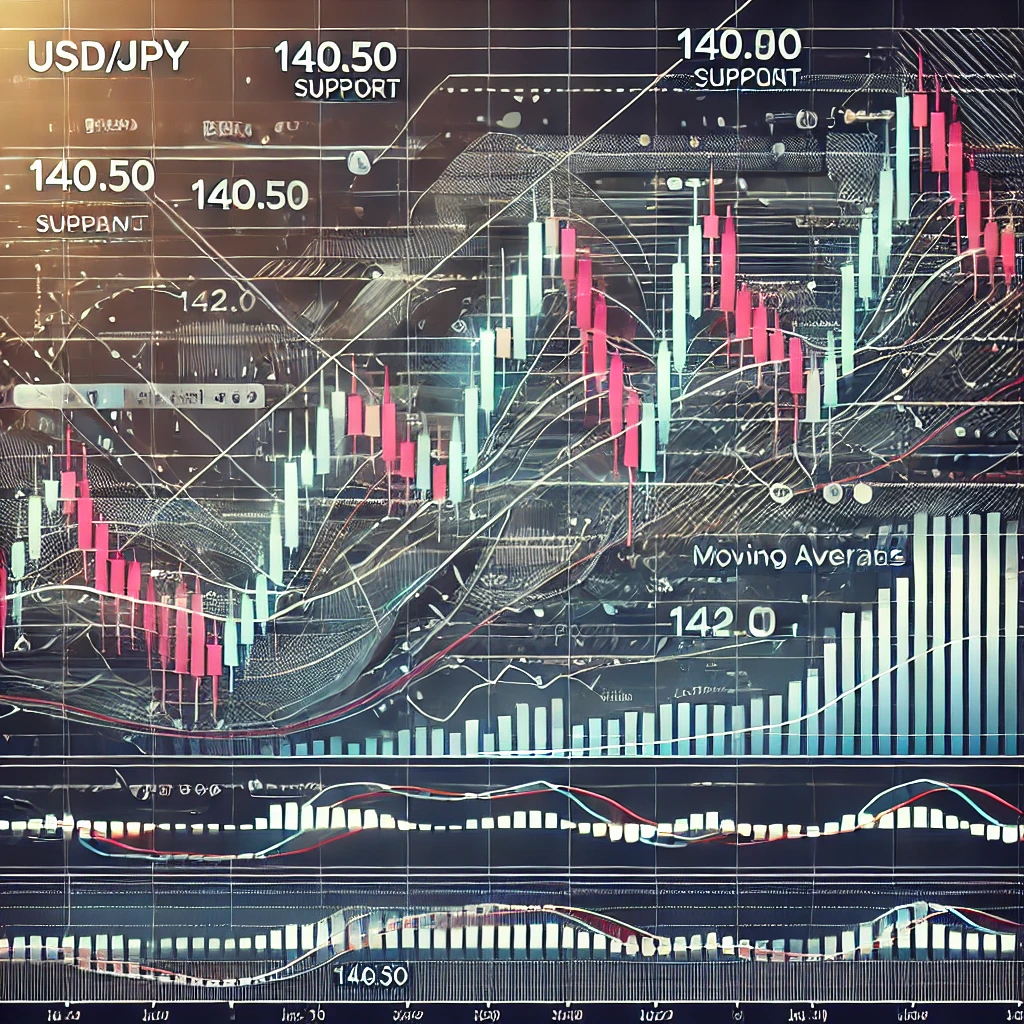

As of the end of August 2024, the USD/JPY pair is trading within a tight range, oscillating between 140.50 and 142.00. This stability comes after a period of significant volatility earlier in the year, driven by the Federal Reserve’s interest rate hikes and Japan’s cautious approach to monetary policy. The US Dollar’s strength against the Yen has been supported by robust economic data from the US, particularly in the labor market, which has maintained pressure on the Japanese Yen.

Key Factors Influencing USD/JPY

Several critical factors are influencing the USD/JPY exchange rate:

US Monetary Policy: The Federal Reserve’s stance on interest rates continues to be a primary driver of USD/JPY movements. The Fed’s hawkish tone, aimed at combating inflation, has led to increased demand for the US Dollar, putting upward pressure on the USD/JPY pair. Investors are closely watching the Fed’s statements for any indications of future rate hikes or pauses, which could significantly impact the pair.

Japan’s Economic Conditions: On the other side, Japan’s economic landscape remains relatively subdued. The Bank of Japan (BoJ) has maintained its ultra-loose monetary policy, focusing on economic stimulation and inflation control. Despite slight improvements in inflation, the BoJ has shown reluctance to raise interest rates, which continues to weaken the Yen against the Dollar.

Geopolitical Developments: Geopolitical tensions in Asia, particularly surrounding Taiwan and North Korea, have also influenced USD/JPY. The Yen, often seen as a safe-haven currency, usually appreciates during times of heightened geopolitical risk. However, the current geopolitical situation has had a mixed impact, with investors showing a stronger preference for the US Dollar due to its perceived stability.

US Economic Data: Recent US economic data, including strong employment figures and steady GDP growth, have bolstered the US Dollar, further strengthening the USD/JPY pair. These data points suggest that the US economy is resilient despite global uncertainties, which has encouraged traders to favor the Dollar over the Yen.

Technical Analysis

From a technical perspective, the USD/JPY pair is showing signs of consolidation within a broader uptrend. The pair has tested the 142.00 resistance level multiple times but has struggled to break above it decisively. The 50-day moving average currently supports the pair, suggesting that the bullish momentum is still intact.

Resistance Levels: The immediate resistance for USD/JPY is at 142.00, with a potential breakout leading to a test of the 143.50 level.

Support Levels: On the downside, the pair finds support at 140.50, with a break below this level potentially opening the door to further declines towards 139.00.

The Relative Strength Index (RSI) for USD/JPY is hovering around the neutral 50 level, indicating that neither bulls nor bears are in full control. Traders should watch for a break above 60 on the RSI for confirmation of renewed bullish momentum.

Trading Strategies

Given the current market dynamics, traders can consider the following strategies:

Range Trading: With the USD/JPY pair trading within a well-defined range, traders could exploit this by buying near the support at 140.50 and selling near the resistance at 142.00. This strategy can be particularly effective in the current market environment, where significant breakout catalysts are absent.

Breakout Trading: For traders looking for more aggressive opportunities, watching for a breakout above the 142.00 resistance could offer potential. A confirmed breakout could lead to a sharp rally towards the 143.50 level. Conversely, a break below the 140.50 support could signal a bearish reversal, with potential short opportunities down to 139.00.

Carry Trade Strategy: The USD/JPY pair is also popular for carry trade strategies, where traders take advantage of the interest rate differential between the US and Japan. With the Fed maintaining higher interest rates, traders can benefit from the interest rate differential by going long on USD/JPY.

Future Outlook

Looking ahead, the USD/JPY pair’s trajectory will largely depend on the interplay between US monetary policy and Japan’s economic conditions. If the Federal Reserve continues its rate hike cycle, the USD/JPY could see further upside. However, any signs of economic slowdown in the US or a shift in Japan’s monetary policy could introduce volatility.

Traders should also monitor geopolitical developments, particularly in Asia, as these could impact risk sentiment and the safe-haven appeal of the Yen. Overall, the USD/JPY pair remains an attractive choice for traders seeking opportunities in the Forex market, with both technical and fundamental factors offering potential setups.

Conclusion

The USD/JPY pair presents a range of trading opportunities as we move into the latter part of 2024. Whether through range trading, breakout strategies, or carry trades, there are various ways to capitalize on the pair’s movements. However, traders should remain vigilant of the key economic indicators and geopolitical developments that could influence the pair’s direction.

By staying informed and applying disciplined trading strategies, traders can navigate the complexities of the USD/JPY market and make informed decisions in this ever-evolving landscape.