Federal Reserve’s Potential Interest Rate Hike In July 2025

Introduction

The Federal Reserve plays a central role in shaping the U.S. economy, particularly through its monetary policy decisions. One of the most significant tools the Fed uses to manage the economy is the federal funds rate. This key interest rate influences everything from consumer spending to business investments and global financial markets.

As we approach the middle of 2025, the question on many economists’ and market analysts’ minds is: Will the Federal Reserve hike interest rates again in July? Inflationary pressures and broader economic conditions are weighing heavily on the decision. In this article, we’ll delve into what’s driving the conversation around a potential rate hike, the factors influencing the Fed’s decision, and what such a move could mean for the U.S. economy and the global financial landscape.

Economic Context Leading To Potential Rate Hike

The current state of the U.S. economy presents a complex challenge for the Federal Reserve. On the one hand, inflation remains a persistent concern, showing no signs of slowing down despite previous rate hikes. On the other hand, there are signs of economic slowdown, particularly in sectors sensitive to borrowing costs, like housing and consumer loans. The Federal Reserve’s goal is to strike a balance between controlling inflation and supporting economic growth, which becomes especially difficult when inflation remains above the target rate of 2%.

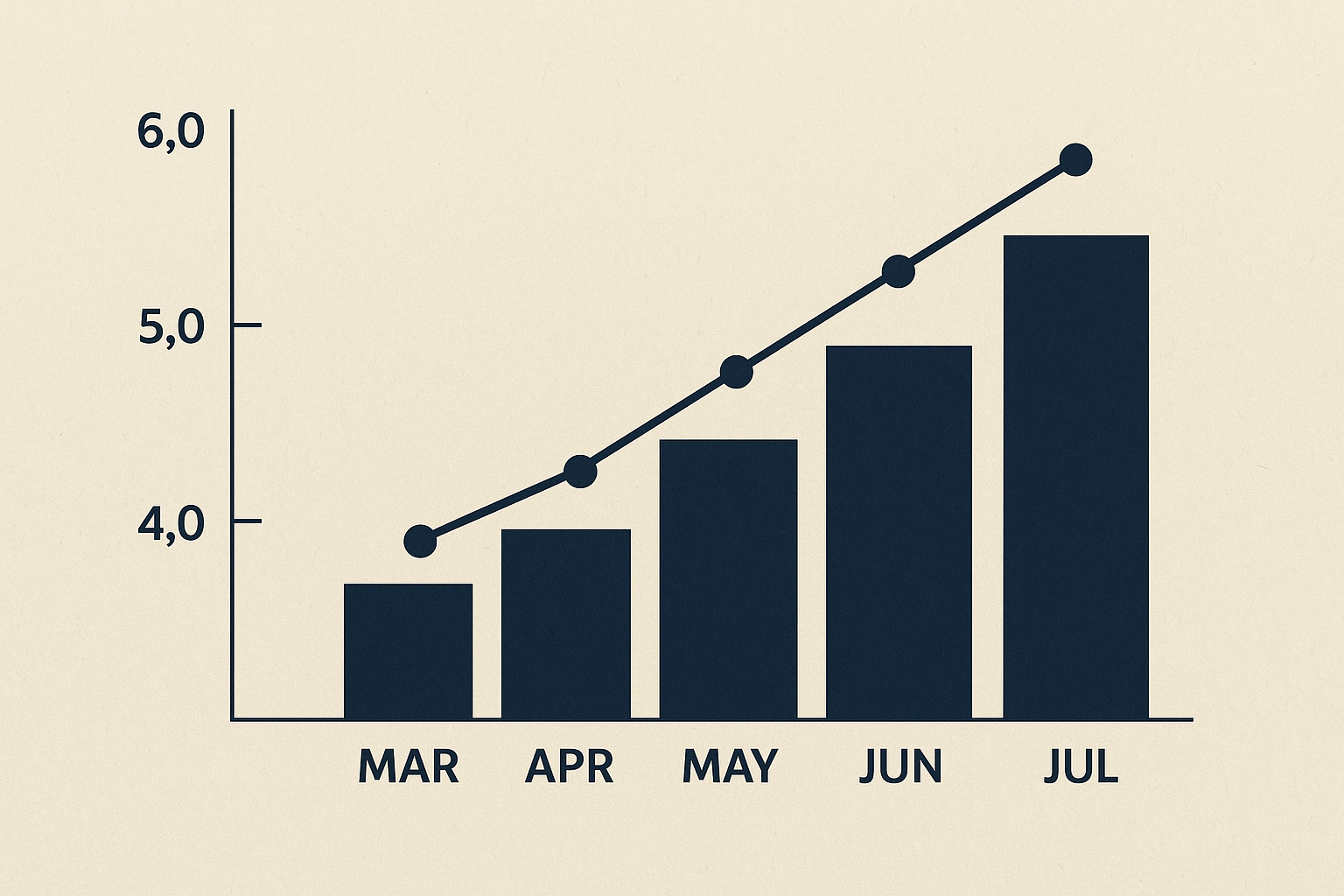

Recent inflation data shows that although prices have come down from their peak in 2022, the rate remains stubbornly high. Core inflation, which excludes volatile food and energy prices, has been especially persistent. The Fed is closely watching these indicators as it prepares for its next meeting in July 2025. Inflation control remains at the top of the Fed’s agenda, and it’s likely that another rate hike will be on the table if inflation continues to stay elevated.

The Federal Reserve’s Decision-Making Process

At each Federal Open Market Committee (FOMC) meeting, the Federal Reserve considers a variety of economic indicators before making a decision on interest rates. The most critical factors include:

Inflation: If inflation remains above target, the Fed may raise rates to cool down the economy.

Labor Market: A strong job market can be a sign of a healthy economy, but it can also fuel inflation if demand for workers drives wages higher.

Economic Growth: The Fed needs to balance controlling inflation with ensuring that the economy doesn’t slip into a recession.

Global Economic Conditions: The interconnectedness of global markets means that the Fed must also consider international factors like foreign central bank policies and trade conditions.

For July 2025, much of the decision-making process will likely be influenced by the latest inflation reports, as well as the overall economic growth outlook for the U.S. Over the past few months, inflation has been moving in a downward direction, but at a much slower pace than the Fed would like.

Inflationary Pressures Driving The Discussion

Inflation has been a major concern for the Fed throughout 2023 and 2024, with consumer prices rising faster than most economists had expected. Despite a few signs of easing, inflation remains well above the 2% target that the Fed aims for. A few key areas continue to drive inflationary pressure:

Energy Prices: Despite falling gas prices in recent months, global energy prices have been volatile, contributing to fluctuations in overall inflation.

Wages and Labor Costs: With a tight labor market, wages have increased in many sectors, driving up costs for businesses, which are often passed on to consumers.

Supply Chain Disruptions: While the global supply chain has recovered from the COVID-19 pandemic, disruptions remain an issue, particularly in the tech and manufacturing sectors.

The Fed has already raised interest rates significantly in the past two years, but it has been cautious about overshooting, knowing that an overly aggressive stance could push the economy into a recession. Despite this, the inflationary pressures mentioned above continue to weigh heavily on the decision-making process.

The Impact Of A Rate Hike On The U.S. Economy

Raising interest rates is one of the Fed’s primary methods for controlling inflation. When the federal funds rate is increased, borrowing costs rise for consumers and businesses alike. This discourages excessive spending and borrowing, which in turn helps reduce inflation. However, there are trade-offs that come with such a decision.

A rate hike could have several effects on the economy, including:

Consumer Spending: As interest rates rise, loans for cars, homes, and credit cards become more expensive. This could result in a slowdown in consumer spending, which accounts for a significant portion of U.S. economic activity.

Housing Market: Higher rates often mean higher mortgage rates. As borrowing becomes more expensive, fewer people can afford to buy homes, potentially cooling down the housing market.

Business Investment: Companies that rely on borrowing to fund their operations may be less likely to invest in growth initiatives, such as hiring or expanding production.

Currency Strength: A higher federal funds rate typically strengthens the U.S. dollar. This could make U.S. exports more expensive abroad, potentially affecting the international competitiveness of U.S. goods.

Global Impact Of U.S. Interest Rate Decisions

While the Federal Reserve’s decisions directly affect the U.S. economy, they also have a significant impact on global financial markets. A higher U.S. interest rate typically attracts foreign investment, strengthening the dollar and raising borrowing costs for foreign governments and businesses. This could lead to tighter financial conditions in emerging markets, where debt is often denominated in U.S. dollars.

Moreover, a higher dollar can also affect trade balances, as U.S. exports become more expensive for foreign buyers. This can lead to a trade deficit and pressure on the U.S. economy. Emerging market currencies, particularly those in countries with high levels of dollar-denominated debt, could come under pressure if the Fed raises interest rates.

What To Expect In July 2025: The Road Ahead

Looking forward, July 2025 presents a critical juncture for the Federal Reserve. As inflationary pressures remain persistent, the Fed will need to decide whether to raise interest rates further or hold steady. If inflation shows signs of leveling off, the Fed may opt to pause the rate hikes. However, if the inflation rate continues to stay above its target, an increase in rates could be the most effective strategy to regain control over price stability.

Moreover, there is speculation that the Fed could take a more cautious approach in the second half of 2025, particularly if there are signs of an economic slowdown. The central bank may decide to pause or slow the pace of interest rate hikes to allow for a soft landing for the economy. However, this approach hinges on several factors, including how inflation responds in the coming months and whether the labor market remains robust.

Conclusion

The next few months will be critical as the Federal Reserve navigates the fine line between controlling inflation and avoiding a recession. The outcome of this decision will shape the economic landscape for the rest of 2025 and beyond.